- …

- …

The Fortune Program Academy

The Next Four Years After High School

The Five Freedoms

The principles behind The Fortune Program Academy

FINANCIAL

Money As A Tool

Making money has two parts. Offense and defense. Develop them both at the same time and see how you can earn, accumulate, and manage money.

INTELLECTUAL

Think For Yourself.

Most people are slaves to their age. They think with the moods of the day. Breaking free from these constraints is the first step toward freedom of the mind.

VOCATIONAL

A World Of Options.

No one can be sure what they'd like to be doing 5 years from now. The key to preparing for the future is to keep opening up your options.

EMOTIONAL

Know Yourself.

Self-awareness can unlock your tensions. and boost you energy. When you understand yourself and others it liberates your relationships.

SPIRITUAL

Happiness As An End.

The Freedom Program and the Five Freedoms work toward the end of happiness. To develop the goods of human nature. A rational soul acting in accord with virtue. [ Aristotle].

- Development of the program

By the late nineties, it was evident that going off to school was no longer a good way for young people to gain their freedom and independence.

Kids were leaving college with crushing debt. And instead of teaching them how to think the schools had become concerned about what they were thinking.

The first edition of the Fortune Program was written in 1998, to lay out an alternative method to empower the next generation; to make sure they had the money and the skills to acquire the five freedoms. How It Works

1Modest Monthly Expenses

Live at home for as long as possible, contributing to the household while establishing one’s own “household”, and contributing modest monthly expenses to get “in rhythm” with real adult life while saving as much as possible.

2Financial Target

Set a financial target for a 4-5 year course. $50-$80,000. Set up a spreadsheet of incomes and expenses over the four years and check their progress against these targets every month or two.

3Debt-Free

Learn to live debt-free and to invest.

4Primary Job

Work a “primary” job where you see how far you can progress in 4 years. This gives one an understanding of how to grow through an existing structure.

5Secondary Job

Work “secondary” jobs (anything that interests you or seems that it could contribute to one’s education, from temporary babysitting jobs to waitressing or working in clothing stores for 6 months or a year, or doing “projects” for a business or family, whatever opportunity arises) that give a view into a lot of different businesses and hobbies to help establish a sense of one’s personal skills and interests. It also gives a frame of reference on how a lot of different companies run their businesses, which can be very helpful later. This also helps build one’s network.

6Read

Read a lot of great business books (it was originally set up as an entrepreneurial training program, but can be modified to particular interests, whether ministry, hunting, coaching, photography).

7Personal Mentor

Have access to business and personal coaches with whom you establish a relationship and learn from. This also builds one’s network.

8Start A Business

If interested in going into business, try to start a business on a small scale on the 3rd or 4th year into the program. This allows it to incubate in a safer place while cash is coming in from other sources.

9Graduate

Finish the Fortune Program Academy classes and life skills development courses.

"What do you call it when 15 graduates of the FPA get together?

A business meeting. Because together they represent over a million dollars in capital. "

Comparing a college degree to the FPA:

Age 22

COLLEGE DEGREE

- Debt–$30,000 on average.

- No Savings.

- Study, writing, and testing experience.

- Public speaking experience, often on social issues.

- A track record of grades.

- Your mentors are professors.

- Your personal connections can help you brainstorm your first big idea.

- Your Peers are competing with you for awards, grades and to get a job.

Age 22

THE FORTUNE PROGRAM

- No Debt.

- $80,000 in Savings.

- Work experience and specialized training in multiple fields.

- Public speaking experience on business and financial issues.

- A track record of investment and cash management.

- Your mentors are entrepreneurs.

- Your personal connections are ready to FUND your first big idea.

- Your peers have capital and are looking to partner with you to start joint ventures.

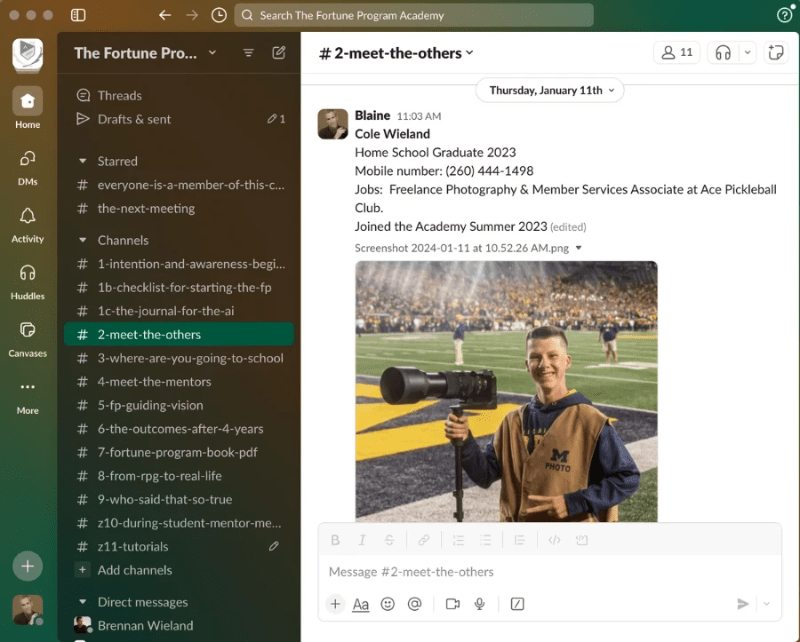

Some of The People Behind The Program

All are homeschooling parents and painfully aware that every kid is unique.

Trent Schrock

- Program Leader

- Admissions

- Jobs & Career Development

As an entrepreneur and business owner, Trent developed the idea of the Five Freedoms as a guide to employee development for his company.

Putting the training into practice, he realized that the same principles could be the basis for a complete education and a great start to working life for young people.He has three young-adult children currently nearing completion of the Freedom Program. He's watched the whole thing play out in real life!

He discovered that kids could be good at financial defense! He also made adjustments to increase socialization opportunities and adapt methods to suit particular temperaments.

Aaron Stoll

- Savings Goals

- Investments

Before law school at Norte Dame, Aaron worked at a bank in their investment and estate planning department.

Now he owns a law practice, which was expected, and is the father of four kids, which was not.

The heart of the Fortune Program is to open up career options for young people, especially business opportunities. In understanding the importance of capital in economics, it was the idea of generating savings at a young age that captured Aaron's attention.

Aaron is fascinated with the "cross-over point," that moment when graduates of the program are making as much money from their investments as from their job.

Jennifer Wieland

- Academy Coordinator

- Curriculum Development

Jen began her teaching career early. As a 10-year-old, she set up classroom instruction for her two brothers!

She formalized her interests with a degree in secondary education from IU Bloomington and has since understood that curriculum development commands her attention.

Her span of research stretched wide as she began homeschooling her three children. And with her oldest son reaching the first-job-stage, preparing him for a future career became top of mind.

She coordinates the Fortune Program academy–the online learning management system where students take their courses. It is a classical style education in that the focus is on developing the life for which they will earn a living.

Get Updates from the Fortune Program Academy

Experience & Money Is Better Than A Degree & Debt

© 2024